What not to miss in the final walk-through of your new home

Originally published at The San Diego Union Tribune

by Pat Setter

It’s an exciting moment, walking into your brand-new home after it’s finally completed. But don’t let the excitement distract you from the importance of this final walk-through with the builder a few days before closing on a home. This is your chance to inspect the home, learn about the mechanics and systems, and note any areas of concern or defect.

The day of your walk-through inspection, arrive on time and in comfortable shoes — and make sure your calendar is cleared so you are free of distractions and obligations during your appointment. Be sure to bring a notebook to make a checklist, and have your smartphone handy to take photos of the items that need to be repaired, as you and your builder representative create the “punch list” of items that need attention. Point out anything you find that needs to be addressed, because after you move in you won’t be able to prove that that scratch on the kitchen countertop wasn’t caused during the move-in.

Once you have a list of repairs, your builder representative (usually a customer service professional) will go over the list and have you approve it, making sure that all your items of concern are noted. Then he or she will go about alerting the correct trade contractor to come back in and correct the work. If that’s after you have moved in, you will be contacted with the day and time the work will be attended to. Once the repairs or corrections are completed, you will need to sign off that the work was done satisfactorily.

Here are some things to look for during your walk-through:

Examine all surfaces, including cabinets, counters, fixtures, floors, windows, ceilings and walls, inside and out. Paint touchups are among the most frequently noted items.

Turn all the faucets on and off and flush the toilets to inspect for leaks.

· Open and close windows and doors to make sure they lock and seal properly.·

· Check to see whether all appliances operate, that they are the correct model and that the appliance handbook is available.·

· Don’t forget to inspect the entire property. Make sure the ground slopes away from the home, so as to avoid foundation problems and flooding. If the landscaping is already in place, look for dead plants and check for areas where water could pool.

The inspection, which can last an hour or two, is also your chance to ask questions about how things work. Be sure to ask where the shut-off valves are for gas, electricity and water in case of an emergency. Although your new home comes with a stack of instruction and warranty manuals, it’s helpful having someone demonstrate the appliances, the heating and air conditioning and the smart-home features that come with many new houses.

During this time, the builder’s representative will also go over the homeowner’s maintenance responsibilities, which are often required to keep warranties in place. Often, builders will schedule a follow-up inspection soon after you’ve moved in and another toward the end of your first year in the home, which marks the end of the warranty for workmanship and material. Small problems, such as a popped nail in the drywall, often arise as the home settles.

During this first walk-through, ask lots of questions. You may choose to have a home inspector professional perform their own inspection of the property. If so, you will need to schedule it with the builder ahead of time before your walk-through. Then, bring along your inspection report to discuss anything of note.

By being diligent upfront, you can ensure that you will be able to enjoy your new home for years to come.

For more information on real estate and recent Home Pride columns, visit:sandiegouniontribune.com/news/business/real-estate/home-pride.

Sincerely,

James Robert Deal

Real Estate Attorney & Real Estate Managing Broker

James

PO Box 2276 Lynnwood WA 98036

Law Office Line: 425-771-1110

Broker Line: 425-774-6611

KW Everett Office Line: 425-212-2007

Fax: 425-776-8081

I help buyers, sellers, brokers. Flat fee payable at closing.

WashingtonAttorneyBroker.com/Helping-Brokers

WashingtonAttorneyBroker.com/Helping-Buyers

WashingtonAttorneyBroker.com/Helping-Sellers

WashingtonAttorneyBroker.com/Seller-Financing

Property search: JamesRobertDeal.com

Mortgage-Modification-Attorney.com

Fluoride-Class-Action.com/Safewater

JamesRobertDeal.org/Smart-Meters

JamesRobertDeal.org/Attorneys-Viewpoint-Vaccinations

JamesRobertDeal.org/Door-To-Door-Transit

WhatToServeAGoddess.com/Music

If you like our work, give us a thumbs up review on Zillow

Listing Broker Co-Brokerage Addendum

As both a real estate attorney and a real estate broker, I co-broker with other brokers, helping them to take more listings and service them better. This provides better service for sellers.

Quitclaim Deeds

What is a quitclaim deed? What is a statutory warranty deed? When should you use a quitclaim deed? When should you use a statutory warranty deed? When is excise tax owing on a transfer of title?

Buy Real Estate In Partnership

Interest rates jumped. Prices leveled off and got soft. Buyers over-reacted and stopped buying. Bad idea. It is time to be buying. You can make an offer without a dozen other buyers competing with you. So what if interest rates are up. What goes up must come down. And prices of real estate always trend upward over time.

Voltage Can Vary

Electricity can't be stored, so when I turn on a light, the power station must immediately produce some extra electricity. How is this possible?...

Become An Attorney Broker

James Robert Deal is both an attorney and a broker. Attorneys can become real estate agents and make more money and deliver better service as attorney brokers. Join The Deal Team with Keller Williams.

Commercial Mortgages

JAMES ROBERT DEALCOMMERCIAL MORTGAGE BROKER Not only am I a real estate managing broker (DOL # 27330) and a real estate attorney (WSBA # 8013), I am...

How Much Does Social Security Pay?

Why does Social Security pay so little in retirement? Jeanine Joy, Ph.D., CEO, Trainer, Speaker, Author, Researcher at Happiness 1st Institute...

Why you can sell homes in the winter

For Sellers, Move-Up Buyers, Selling Myths The #1 Reason to List Your House in the Winter · 2.1Kshares · 1.9K · 82 · 33...

4926 212th Street SW MLT 98043

Mountlake Terrace Planning has reviewed architectural plans for the construction of a 15 unit apartment with 17 parking spaces at 4926 212th Street SW Mountlake Terrace WA 98043 and has indicated approval subject to meeting a list of reasonable requirements.

4017 Colby Everett

JAMES ROBERT DEALREAL ESTATE ATTORNEYREAL ESTATE MANAGING BROKERCOMMERCIAL MORTGAGE BROKEReXP Realty 425-774-6611James@JamesDeal.com I am writing...

Are Rich People Mean? – How Much Is Enough?

Why Are Rich People So Mean? Call it 'Rich Asshole Syndrome'—the tendency to distance yourself from people with whom you have a large wealth...

Helping Other Brokers

I am a real estate broker and a real estate attorney. I help buyers, sellers, and other brokers throughout Washington. Call me at 425-774-6611 when your purchase or sale involves legal issues. I can often quote a flat fee payable at closing.

Vaccines Wear Off – Cannot Provide Permanent Protection – Cannot Produce Herd Immunity

Is MMR Vaccine a Fraud or Does It Just Wear Off Quickly? by Joseph Mercola, DO | Guest Writer Published May 8, 2018 | Vaccination, Risk &...

LED Street Lights Reduce Property Values – Harm Eyes – wear blue blockers

LED Street Lights Reduce Property Values - Harm Eyes wear blue blockers AMA adopts guidance to reduce harm from high intensity street lights ......

Cell Towers, Smart Meters, 5G – They All Depress Property Values

www.JamesRobertDeal.org/smart-meters Cell Towers, Smart Meters, 5G - They All Depress Property Values Cell Towers, Antennas Problematic for Buyers...

Nina Beety’s 50 page Smart meter hazards report

From James: Smart meters reduce the value of your property. They cause fires. Some damage caused by electrical surges are not covered by insurance....

Anti-vaxxer want informed consent and liberty

Anti-vaxxer want informed consent and liberty Ada Drinkwater, Wife mother grandmother great grandmother Liberty & informed consent are not only...

New York Times – Another Industry Captured Corporation – 5G Must Be Good Because Evil RT Warns It Is Unsafe

From James Robert Deal: Too much microwave radiation will make our cities and towns hard to live and work in. We will be fried by smart meters and...

Tetanus Vaccine – TDaP – No Proof Of Safety

The US Institute of Medicine concluded that the evidence is inadequate to accept or reject a causal relationship between the DTap vaccine and...

I just don*t thing being an adult is gona work for me

Please just overlook the atrocious grammar in three of these. They are not editable but they ARE too good to delete. Contentment is not the...

Sign In

CLICK HERE TOSIGN UP FOR A BETTER PROPERTY SEARCH TOOLYou will be asked for your email address and your telephone number.You do not have...

Buyer Broker Co-Broker Agreement

James Robert Deal co-brokers with other brokers on complex deals. This is a buyer broker co-broker agreement.

JR-Deal-NewZ-2-8-2019

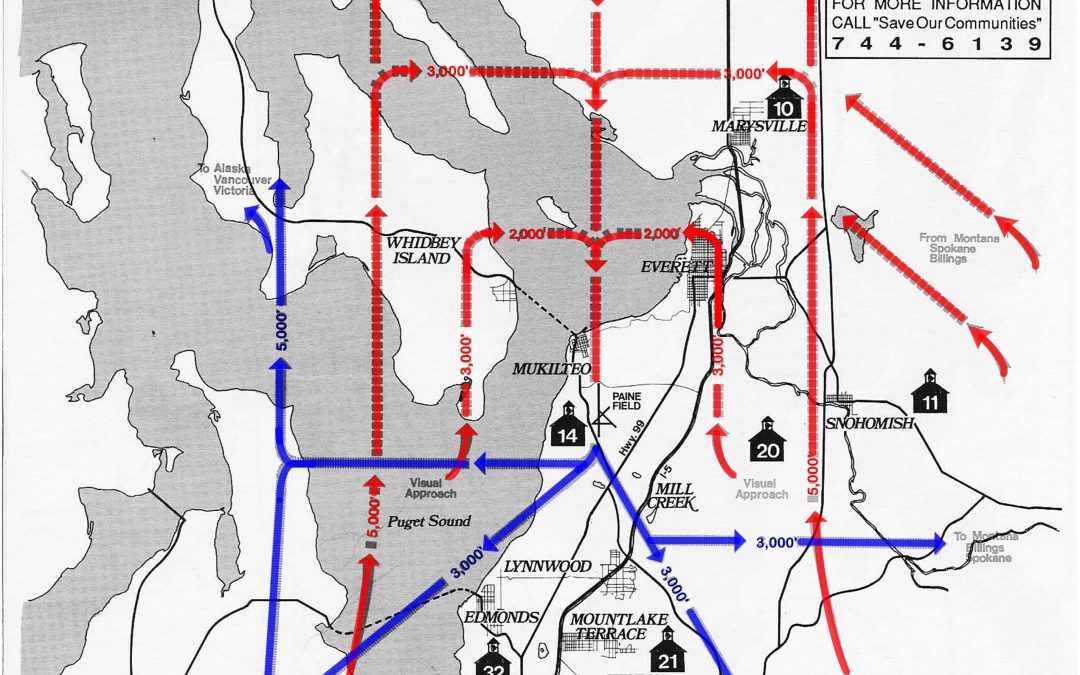

Eliminate traffic congestion. James Robert Deal managing broker. Become a real estate agent.

Home Renovation Can Cost A Lot

Reality check: Don’t fall for these TV home renovation fibs Kitchen and bathroom remodels can cost more and take longer than HGTV shows lead you to...

Funny Mockery of Ineffective Government – From An Opponent of Single Payer

From James: Some points are valid. Some are not. But this is well written and sometimes funny. One of government’s problems is that elected...

IRS Provides Clear Test on How 20% Deduction Applies to Rental Income, Exchanges

Real Estate Calculations Every Investor Should Memorize

The Top 8 Real Estate Calculations Every Investor Should Memorize by Andrew Syrios | BiggerPockets.com...

An additional inspection can cut short the time for the original inspection

An additional inspection can cut short the time for the original inspection QUESTION: I’ve always been under the impression that when a buyer sends...

Ten Mistakes Investors Should Avoid

10 Lethal Mistakes to Avoid on Your First Real Estate Investment by Chad Carson | BiggerPockets.com...

How to Make Earnest Money Non-Refundable

Click here if you are having trouble viewing this message. Weekly Membership Newsletter JANUARY 8, 2019 • Stay Connected! QUESTION: I have been...

4 Different Types of LLCs and the Ways They Pay Taxes

4 Different Types of LLCs and the Ways They Pay Taxes by Scott Smith | BiggerPockets.com...

Why I Walked Away from a 118-Door Apartment, 10 Essential Real Estate Team Members & What to Do When Your Tenant Gives Notice

Support Our Sponsors: For Accredited Investors Only. Syndicator of multifamily investments, Ashcroft Capital. Co-founder, Joe Fairless,...

Home Inspection Questions

What Buyers Should Ask After a Home Inspection October 9, 2018 After an inspector has finished a home report, buyers may feel overwhelmed by any...

Door Knocking to Find Real Estate Sellers

29 Door Knocking Resources for Successful Lead Generation Posted by REDX January is the perfect time to door knock. Most people wait until the...

Radio – 9-16-2018 8 PM Eliminating Traffic Congestion 9 PM Buying Real Estate in Partnership – James Robert Deal – Attorney Broker

JR-DEAL-NEWZ-9-16-2018 WASHINGTON POLITICS JAMES ROBERT DEAL, BROKER, ATTORNEY, ENVIRONMENTALIST, AMATEUR MUSICIAN Radio Program – Sunday, September...

How To Choose A Domain Name – by Saul Klein

Choosing Your Domain in the Age of Dot ANYTHING Written by Saul Klein Posted On Friday, 14 September 2018 13:00 ·...

Mistakes Sellers Make

5 Mistakes Home Sellers Make Written by David Reed Posted On Friday, 14 September 2018 21:56...

Small 5G Cell Towers in Neighborhoods Reduce Property Values

CITY COUNCIL DENIES APPEALS OF CELL TOWER INSTALLATION Sam Catanzaro , Santa Monica Mirror, August 31, 2018 Wireless carrier Sprint wants to install...

15605 Cascadian Way Bothell WA

15605 Cascadian Way Bothell Washington. $430,000. 3 bedrooms, 2 bathrooms. Buy on FHA Rehab Loan. Hold long term. Eventually sewers may be extended 400 feet, and then two homes, two duplexes or five townhouses can be built. James Robert Deal, Attorney and Broker, 425-774-6611.

Cell Towers Reduce Property Values

Survey by the National Institute for Science, Law & Public Policy Indicates Cell Towers and Antennas Negatively Impact Interest in Real Estate...

Reciprocal Easements by Prescription

Reciprocal Usage Easements? What is the Purpose? Many buildings that were constructed prior to the 1960s lacked adequate parking, and/or even...

There may be a short statute of limitations on your credit card debt

Shortening the Limitations Period on Credit Card Collection Lawsuits Jon Sheldon August 6, 2018 Print/Download Email link to this article CONTENTS ·...

The Downside of Smart Homes

The Downsides Of Selling A “Smart Tech” House Posted on August 4, 2018Natural Living · · · · · · ·...

Cancelling, Restructuring, Extending, Deferring, Rehabilitating, Consolidating Student Loans

Student Loan Repayment Rights: Consumer Debt Advice from NCLC Joanna Darcus August 2, 2018 Print/Download Email link to this article CONTENTS...

Where Americans Move To – Where they Moved From

Just a few years ago, experts indicated Americans (especially young Americans) were more interested in a different lifestyle than previous...

Selling FSBO Can Cost Sellers A Lot Of Money

Selling Your Home Solo to Save Money? You’ll Actually Make Less Than You Think Posted in Economist Commentaries, by Amanda Riggs on July 9, 2018 385...

Renew the National Flood Insurance Program (NFIP)

RENEW FLOOD INSURANCE BUT QUIT SELLING NEW COVERAGE AND QUIT BUILDING NEW HOMES IN FLOOD ZONES SEA LEVELS ARE RISING Can't read or see images? View...

Underwater Properties – Due to Climate Change

Climate Change Will Force the Poor From Their Homes Low-Lying towns and Homes in Washington will be affected too Alamy This story originally...

18809 65th Place W Lynnwood

18809 65th Place West Lynnwood WA 98036. This house has “good bones.” It needs fixup, cleanup, and your love.

Co-Broker

As both a real estate attorney and a real estate broker, I co-broker with other brokers, helping them to take more listings and service them better. This provides better service for sellers.

Call A Real Estate Attorney BEFORE You Buy or Sell

Call a real estate attorney BEFORE you buy or sell property. Call Attorney James Robert Deal at 425-774-6611. In many cases I offer a flat fee, payable at closing out of escrow.

How Much Is Your House Worth?

What is your Washington home worth? Click here to find out.

JRDeal-NewZ-12-13-17 CDC Manipulated Results Anthrax Vaccine Sickens Soldiers

JRDeal NewZ JAMES ROBERT DEAL Political Activist - Real Estate Attorney - Real Estate Broker 425-774-6611 December 3, 2017 Read Online at:...

Puget Sound Market Prices Up

Home prices in Seattle have doubled over the past five years.

Questions To Ask Before You Buy A Home

Questions to ask before you buy a home.

Prince Did Not Have A Will – Do You?

Prince died without a will. Do not make the same mistake.

The Foreclosure Train Rolls On

Private corporations such as Loan Star and Caliber bought thousands of mortgages. The government pays them to modify mortgages, but they are quick to foreclose. They invest in high value instead of low value homes. They should be required to serve the interest of the local neighborhood as are banks. They should be regulated as banks.

Buy This Book – Chain of Title

Chain of Title How Three Ordinary Americans Uncovered Wall Street’s Great Foreclosure Fraud Purchase hardcover — $27.95 Available: April 2016...

You Need A Lawyer When Doing A Modification

You should be represented by an attorney when you are modifying your mortgage. Servicers break the rules.

Mortgage Modification Successes

Most of our clients are people who tried to modify their loans on their own and failed. Mortgage modifications are tricky. There are procedures...

Banks Losing Right to Require Arbitration

CFPB may allow consumers to sue banks and file class action cases. Banks will not be able to hide behind mandatory arbitration.

Bothell Real Estate Attorney

I am a real estate attorney serving Bothell, Washington. Contact me at 425-771-1110 or 888-999-2022.

Real Estate Attorney And Real Estate Broker

James Robert Deal is both a real estate agent and a real estate attorney practicing in Lynnwood Washington. If He is your broker, he does not charge extra for legal work related to your transaction.

Author

What To Serve A Goddess When She Comes For Dinner Welcome To My Book I highly recommend it. I had a lot of fun writing it. My book has 464 page...

Buyers With a Good Down Payment But Poor Credit

If you are a would-be buyer who has a good down payment and good income but poor credit, I am willing to help you buy property on a lease-option or contract basis. James Robert Deal, attorney and broker. 425-771-1110

Seeking Lease Option and Contract Sellers

Seeking Lease-Option and Seller Contract Sellers Open Phone Line to Brokers, Buyers, Sellers 425-774-6611 - 888-999-2022 I am working with...

Let Freedom Ring – Song

Let Freedom Ring – a song by vaccine rights attorney Allan Phillips.

Underwater Properties – Short Sales – Modification

James Robert Deal, real estate attorney and real estate agent, handles mortgage modifications and short sales.

Condo Dues – Short Sale Then Bankruptcy

Deal with unpaid condo dues by short selling the condo and going through Chapter 7 bankruptcy.

Open Telephone Line

James Robert Deal, Attorney and Broker, in Lynnwood Washington

Blacks Against Mandatory Vaccination

African-American community rages against manditory vaccination in California and the Tuskegee-like crimes of mandatory vaccines that destroy black...

$5,000 Principal Reduction

Republicans want to put an end to HAMP and Making Home Affordable.

Services We Offer

We have an open telephone line to brokers, buyers, sellers, and clients in general who may need help with buying or selling real estate or who may...

Door-To-Door Transit

Door-To-Door Transit: The Only Solution To Our Traffic Nightmare by James Robert Deal, Attorney Traffic is bad and getting worse, and there is no...

Seller Financing History

AN ABBREVIATED HISTORY OF CREATIVE FINANCING AND SELLER FINANCING. The first form of financing was seller financing.

I Help Brokers Do Seller Financed Deals

Attorney James Robert Deal helps brokers structure seller financed real estate transactions.

Lease-Option Deals Open Doors

LEASE-OPTION AND LEASE PURCHASE DEALS A lease-option or lease-purchase deal is a form of seller financing. With the lease-option deal, title stays...

Helping Sellers With Seller Financing

Attorney James Robert Deal helps sellers who are sell using seller financing, including assumptions, wrap-arounds, real estate contracts, or lease option.

Servicers Make More Money By Modifying Than By Foreclosing

Thanks to Martin Andleman and Mandleman Matters Why Does Ocwen Want to Modify Loans? Answer: Because they profit by doing so. In case you...

Zombie Foreclosures

CFPB: Zombie foreclosures hurt borrowers The Consumer Financial Protection Bureau is keeping an eye on “zombie” foreclosures, which it worries cause...

New Federal Rules on Foreclosure

New Federal Rules on Foreclosure —By Erika Eichelberger - Thanks to Mother Jones On Thursday, the Consumer Financial Protection Bureau, the federal...

Washington MERS Suits Fail

Judges Dismiss MERS Suits By Evan Nemeroff Two borrower-initiated lawsuits alleging that the Mortgage Electronic Registration Systems role in the...

Eminent Domain – Tool For Principal Reduction

There are homes by the thousand in which the home mortgage is in default and in many cases the homes are abandoned. These are homes where the...

Chapter 13 Plan Duration

No Minimum Time Length For The Ninth Circuit by Bankruptcy Law Network (BLN) Written by Michael G. Doan Thanks...

Modification on Rental

It is harder to get a mortgage modification on a rental property than it is on an owner occupied property. The rules are not as clear. You need a...

Making Home Affordable Continues

HAMP continues aiding borrowers Three firms still fall short in meeting servicing goals. Thanks to Housing Wire. Kerri Ann Panchuk December 9, 2013...

Rental Property Modification

This is a rental property modification. Ocwen was the servicer, and the investor was Washington Mutual and now Chase. The owner quit paying for 20...

$157,105 Wells Fargo Principal Reduction

JS is a hard working taxi driver. He came to us after a financial hardship, including a divorce. Ocwen is his servicer, however, the important fact...

Wells Fargo – 3 Year Modification

It is a long story, which I will tell later. For now I will just share the link with you and tell you that this modification took three years to...

Preferences

What is a Bankruptcy Preference? by KENT ANDERSON on AUGUST 16, 2010 A bankruptcy preference is a transfer made shortly before the case is filed...

Principal Reduction Modification

We just negotiated this excellent modification with Bank of America. The interest rate was reduced to 2.0%. The principal balance was reduced by...

Condemn Underwater Mortgages – Martin Andelman

Carpe Domum! The Little City that Could: Richmond, California THANKS TO MARTIN ANDELMAN Come with me to the City of Richmond in Northern...

How Long Before I Can File BK Again?

How Long Before I Can File Bankruptcy Again? There is no limit on the number of bankruptcy cases that one may file, nor on the time which must pass...

Deceptive Practices in Foreclosures

Deceptive Practices in Foreclosures Thanks to the New York Times September 13, 2013 In early 2012 when five big banks settled with state and...

Low Modification Approval Rate

This post comes from Martin Andelman. The low approval rate on modifications Martin discusses is the main reason why you should hire an attorney to...

Bankruptcy Timing

Bankruptcy Timeline Posted on August 21, 2013 by Jonathan Mitchell Thanks to Attorney Jonathan T. Mitchell. Caution: This timeline does not include...

Renters’ Rights in Foreclosure`

Renters in Foreclosure: What Are Their Rights? Federal law gives important rights to tenants whose landlords have lost their properties through...

Eminent Domain To Modify Loans

A City Invokes Seizure Laws to Save Homes Peter DaSilva for The New York Times Thanks to New York Times. Robert and Patricia Castillo paid $420,000...

Fannie and Freddie Loosen Modification Guidelines

FHFA expands suite of loan mod tools By Kerri Ann Panchuk • March 27, 2013 • 9:00am Servicers dealing with loans guaranteed or owned by Fannie...

Lenders Lie to Modification Applicants

We have found that Lenders often take advantage of those who apply for modification on their own. Lenders tell them they have not received certain...

Bank of America – Fannie Modification

HMH came to me following a financial hardship. He faced high payments on his Bank of America serviced loan, with a rate of 5.625. The investor is...

Seller Financing

We are coming out of a decade where interest rates were very low, as low as 2.5% per year. Rates are now up over 7.0%. This makes it hard for buyers...

Banks Forgive Mostly Worthless Seconds

The Second-Mortgage Shell Game By ELIZABETH M. LYNCH Thanks to the New York Times IN January, federal regulators announced an $8.5 billion...

More Foreclosures Coming

Where is the housing market going in 2013? Thanks to CBS News (MoneyWatch) The housing market in 2013 stands on a precipice. While there is...

Zombie Titles

The latest foreclosure horror: the zombie title By Michelle Conlin Thanks to Reuters. COLUMBUS, Ohio | Thu Jan 10, 2013 1:58pm EST (Reuters) -...

Consumer Financial Protection Bureau Guidelines

U.S. Consumer Watchdog to Issue Mortgage Rules By EDWARD WYATT Thanks to New York Times Published: January 10, 2013 WASHINGTON — Banks and other...

Aurora, Bank of America, Citibank, Chase, MetLife, PNC, Sovereign, SunTrust, U.S. Bank, Wells Fargo –

Independent Foreclosure Review to Provide $3.3 Billion in Payments, $5.2 Billion in Mortgage Assistance WASHINGTON--Ten mortgage servicing companies...

Calibur – Formerly Vericrest

Mortgage modification is the practice of law. Dealing with Caliber Home loans is not easy. Get legal representation.

Debt Forgiviness Will Be Imputed Income Unless Congress Acts

Beware of IRS Tax Whammy With Short Sales and Mortgage Modifications in 2013 Posted on Wednesday (December 26, 2012) at 6:00 pm to Mortgages &...

Filing for Bankruptcy Does Not Create Tax Consequences

Filing for Bankruptcy Does Not Create Tax Consequences Written by Craig D. Robins, Esq. Thanks to Long Island Bankruptcy Attorney I was prompted to...

Obama to Replace DeMarco – Stingy Leader of Fannie and Freddie

BYE-BYE DEMARCO! Obama to Replace Director of FHFA 3 You know, I was having kind of a crummy day… nothing serious, just dragging my feet a bit and...

California Puts Attorneys Out of the Modification Practice

California State Bar RECENT Decision to Cause More Harm to Homeowners in Foreclosure Thanks to Martin Andelman It’s hard to imagine anything...

Stratigic Default

Giving Up and Getting Out Foreclosures are no longer a last resort, and a growing percentage of americans think it’s ok to strategically default...

Jumbo Modification

A residential property where the first loan was more than around $729,000 at the time of the default is not eligible for modification under the...

What Caused the 2007 Crash

The Trillion Dollar Mistake That Triggered the Economic Meltdown Thanks to Martin Andelman It was summer, 2006, and Fed Chair Alan Greenspan had...

Strategic Defaulters – To Jail With You

FHFA Looking to Jail Strategic Defaulters by my friend Martin Andelman The Federal Housing Finance Administration (“FHFA”), which is the...

Still No Justice for Mortgage Abuses

Still No Justice for Mortgage Abuses September 1, 2012 Thanks to New York Times It has been six months since the big banks settled with state and...

Modifying Loans on Rental and Commercial Property

Under HAMP Tier 2, the Making Home Affordable program was extended to cover one to four unit residential rental properties. HAMP Tier 2 went into...

List Your Lawsuit When You File BK

What Happens When a Debtor Forgets to Schedule a Personal Injury Suit Thanks to Long Island Bankruptcy Blog Posted on Tuesday (August 21, 2012) at...

Successful Citi Modification

On this modification with Citi there was no principal reduction because the property was not underwater. However, the interest rate was reduced from...

Midland Mortgage Modification

We negotiated a good deal for Dennis and his wife. They went from a 9.5% rate to 2.0% for five years, then 3.0% for a year, and 3.875% for the...

OCWEN – Principal Reductions – 2% Rate

OCWEN Principal Reduction: We negotiated a $93,000 principal reduction for this couple, provided they remain current on their payments for three...

Misconceptions About Modifications

Read Richard Fonfrias on Seven Costly Misconceptions About Mortgage Loan Modifications:...

Who is Liable on Business Credit Cards?

Business credit cards and the individual bankruptcy case by Cathy Moran, California Bankruptcy Lawyer Small corporations may have their names on the...

Can I keep a credit card out of bankruptcy?

Can I keep a credit card out of my bankruptcy? by Chip Parker, Jacksonville Bankruptcy Attorney...

Happy Clients

I only post a quarter of the modifications we complete, and I have not posted any of them for some time.I will get caught up on that job when we get...

Forensic Audits Not Useful

Homeowners: Don’t Be Scammed by Forensic Audit of Mortgage Docs Posted: 19 Jun 2012 10:00 PM PDT Written by Craig D. Robins, Esq. Unfortunately,...

Should You Reaffirm a Mortgage in Bankruptcy?

Should You Reaffirm a Mortgage in Bankruptcy? 12 Jun 2012 05:00 PM PDT Written by Craig D. Robins, Esq. Reaffirming a debt in bankruptcy means that...

Life Estates and Remainder Interests Are Exempt in Bankruptcy Cases

Life Estates and Remainder Interests Are Exempt in Bankruptcy Cases Posted: 09 Jun 2012 10:00 AM PDT United States District Court, In Case of First...

Martin Andelman on HAMP 2

HAMP 2 is HERE Some say it’s the best HAMP yet, and they’re probably right about that. by Martin Andelman This past year has been transformational...

Stripping 2nd Lien in Chapter 7, 13

Can I Strip A Second Mortgage In A Chapter 7 Bankruptcy? by Carmen Dellutri, Southwest Florida Bankruptcy Attorney A Chapter 7 Bankruptcy Debtor can...

When can you file bankruptcy again?

When Can I File Bankruptcy Again? by Bankruptcy Law Network There is no limit on the number of bankruptcy cases that one may file. In fact, there is...

Debt Settlement

Don’t File Bankruptcy! by Douglas Jacobs, California Bankruptcy Attorney That’s the cry of the “debt settlement” industry. They claim that they...

Bank of America Principal Reductions

Bank of America has started sending letters to thousands of homeowners in the United States, offering to forgive a portion of the principal balance...

Divorce During Bankruptcy

Divorce during Bankruptcy by Andy Miofsky, Illinois Bankruptcy Attorney One of the leading causes of marital conflict involves money, or lack...

Foreclosure and Income Tax Consequences

Foreclosure and Its Income Tax Consequences (TheNicheReport) — In a recent issue of The Niche Report I wrote an article on how to safely “walk away”...

Wells Fargo and Robo Signing

By Travis Waldron, Think Progress Posted on April 20, 2012, Printed on April 21, 2012...

Is consumer protection enough to fix housing?

Is consumer protection enough to fix housing? HW Magazine April 2012 by Christopher Whalen It is an election year and, no surprise, President Barack...

Washington Supreme Court Hears MERS Case

WA State Supreme Court Hears Arguments in Case Against MERS “May a party be a lawful ‘beneficiary’ under Washington’s Deed of Trust Act if it...

How Many Kids Have Fluorosis?

4-1-12 Thanks to Paul Lamoreaux of Port Angeles who tracked down the information I needed: I wanted to know how many kids there are in the US age 12...

Making Home Affordable Encourages Principal Reductions

Making Home Affordable Encourages But Does Not Require Principal Reductions HAMP has increased financial incentives to servicers for principal...

Principal Reductions May Be Coming

Freddie CEO signals GSE principal reduction could be soon By Jon Prior • March 23, 2012 • 11:14am Freddie Mac CEO Charles "Ed" Haldeman gave a...

No Free House

Filing Bankruptcy And Getting Your Free House by Jay Fleischman, New York Bankruptcy Lawyer I’ve been meaning to tell you something for awhile now....

Lauren Willis – Condemn mortgages and write them down

GUEST POST: Good for the Banks, Good for the Borrowers by Law Professor, Lauren E. Willis Good for the Banks, Good for the Borrowers By Lauren E....

FHA refinancing program means savings for those who can qualify

FHA refinancing program means savings for those who can qualify The Obama administration's new plan to stimulate refinancings of FHA mortgages is...

Raise the Minimum Wage

Ralph Nader: Minimum Wage Needs To Catch Up With 1968 – OpEd Written by: Ralph Nader March 1, 2012 How inert can the Democratic Party be? Do they...

CA Attorney General Asks Fannie & Freddie to Stop Foreclosing

Atty. Gen. Kamala Harris ASKS Fannie and Freddie to Stop Foreclosing Did you hear about this? California’s Attorney General, Kamala Harris has...

Pooling and Servicing Agreement Look Up

HOW TO FIND YOUR POOLING AND SERVICING AGREEMENT It may be very valuable to your case for you to have a certified copy of your Pooling and Servicing...

Arizona asserting right to write down mortgages

Arizona’s SB 1451 – Does Arizona Have the Right to Save Itself from Drowning in Underwater Loans? Drowning in the desert. The irony alone could...

40 Million McMansions

America has 40 million McMansions that no one wants By Christopher Mims 9 Feb 2012 11:12 AM Americans, especially generations X and Y, want...